What are the Basic Facts on Amendment 1?

Passage of this amendment is critical to the future of Florida and it will put money back into the hands of most Florida property owners.

1) The property tax cut plan on the January 29 ballot would save taxpayers nearly $10 billion over five years.

2) Floridians have the power to cut property taxes by voting 'Yes on 1' on January 29, 2008.

3) Property taxes have doubled in the past six years, outpacing the average growth of homeowner’s salary.

4) Local governments have used their increase in revenues to greatly expand their budgets and reserves, instead of returning it to Florida’s families and small businesses.

What are the key benefits of Amendment 1?

Where Can I Get More Information on Amendment 1?

For more information about Amendment 1, visit: www.YesOn1Florida.com.

How Will Floridians Gain Property Tax Relief?

With the passage of Amendment 1, citizens will gain the freedom to purchase a new home without huge tax penalties, and rental home owners, second home owners and businesses will benefit by limited future tax increases. The amendment contains two provisions: doubling the homestead exemption and portability of the Save Our Homes tax benefit.

1) Double the homestead exemption for almost all homeowners, providing an average savings of about $240 annually. The new exemption applies fully to homesteads valued over $75,000 and partially for homesteads valued over $50,000. This new exemption does not apply to school taxes.

2) Allow portability: The Governor has heard from many constituents that they feel trapped in their homes. Portability will allow homeowners to transfer their Save Our Homes tax benefits from their old home to a newly purchased home. Portability applies to homes purchased in 2007 and later, and the benefit is capped at $500,000.

How Does Portability Help People Who Want to Move?

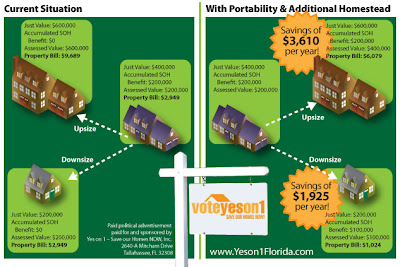

Amendment 1 benefits those who want to move into a different home, seniors seeking to downsize, and business owners facing rising property values.

Looking for a larger house?

If you bought a house for $95,000 in 1995 and its current market value now is $300,000 and the assessed value is only $150,000-- you could transfer the full $150,000 difference to buy a more expensive home.

If the purchase of your new home costs $400,000, you would be paying about $6,300 in taxes without portability. But with the tax savings from Amendment 1 including the Save our Homes portability and the double homestead exemption, the new annual taxes would be about half or $3,600.

Want to downsize?

Under the new tax plan, portability also will apply if you want to move to a less expensive property. Instead of transferring the difference, your transfer will be your existing Save our Home percentage.

For example, if you live in a $300,000 house with an assessed value of $150,000, you pay taxes on $125,000 or about $2,100. If you wanted to move to a $200,000 condo the savings will be significant.

In this case, you would bring 50% or $100,000 in savings that reduces your assessed value to $100,000 on the new property. With the newly increased $50,000 homestead exemption from Amendment 1, the taxable value for all local government taxes other than school taxes would fall to $50,000. The new total annual tax bill would be about $1,000 or about half of the old tax bill.

Do you live in a mobile home?

More than 1.1 million Floridians currently live in mobile home or manufactured housing parks and communities. Currently, if you live on a leased lot in a park or community, you are paying tangible personal property taxes on your porches, sunrooms, storage rooms, and carports. With the passage of Amendment 1, you will have an exemption up to $25,000…so most of you will no longer pay this tax at all!

Comparison chart

How would Amendment 1 help rein in local government spending?

Amendment 1 isn't just about cutting taxes. It is about controlling government spending. It is a reality check for local governments that feasted on escalating property values over much of the past decade instead of lowering tax rates. As property values rose, tax collections soared. Levies doubled between 1997 and last year, including 42 percent in just three years. Property taxes grew three times faster than growth in population and inflation combined. Even after lawmakers approved a rollback of the tax rate last year, almost half of Florida's cities and counties set their rates higher. Others raised fees for services, like fire protection, that should be paid for through property taxes.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

No comments:

Post a Comment