Friday, March 21, 2008

How Do I Save My Home?

The US Department of Housing and Urban Development (HUD) has a website that tells homeowners what they can do to save their homes. Please click on the link below to read the information.

How Do I Save My Home?

All the Best,

Amit

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Monday, March 10, 2008

Is Your Landlord Paying His Mortgage?

I read a really good article in the Miami Herald about this. Please click on the link below for the story.

Is Your Landlord Paying His Mortgage?

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Friday, March 07, 2008

What Really Matters?

What Really Matters? (video)

Thanks,

Amit

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Thursday, March 06, 2008

The Latest Foreclosure Statistics

Florida and California, states with significant investor speculation and overbuilding during the real estate boom, helped push the percentage of homes entering foreclosure nationwide to record highs, an industry group reported Thursday.

Together the two states had 21 percent of all outstanding loans but were responsible for 30 percent of new foreclosures in the three-month period ending Dec. 31, according to numbers released by the Mortgage Bankers Association.

In Florida, 10.69 percent of borrowers with first lien home loans were behind on payments or in foreclosure, compared to 7.86 percent nationwide, the report said.

The percentage of new foreclosures in the state rose to 5.19 percent from 3.52 percent in the previous quarter, driven by a large percentage of defaults among subprime borrowers who got loans despite shaky credit.

More than 17 percent of all subprime loans entered foreclosure in the fourth-quarter, compared to just 2.66 percent of prime loans.

MBA economist Doug Duncan said the state's foreclosure problems were the result of interest rates resetting on adjustable-rate loans coupled with falling home prices.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Monday, March 03, 2008

Are Foreclosures Good Deals?

With so many homes on the market that aren't foreclosures, there are just as many great deals within these group of homes for sale. There are still a huge number of people that have lived in their homes for many years. These homeowners still have a great deal of equity, and many of them are in position to offer an incredible deal to a potential buyer to make their home stand out from all the competition. So how does someone get the best deal in today's real estate market? The answer is the same as it has always been - speak to an experienced Realtor with knowledge in the area you are interested in.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Thursday, February 28, 2008

Top 10 Reasons It's a Great Time to Buy Real Estate NOW!

- Selection, selection, selection. There are about 57,000 resale homes on the market in Maricopa county(Phoenix). Regardless of the price range a buyer desires, there are plenty of houses from which to choose. Just a few years ago the resale inventory dropped below 5,000 units. A buyer was forced to make compromises if they were going to locate the home of their dreams. There is a great selection of attached homes, condos, and townhouses. You can find large lots, small lots, and a lot that will accommodate your boat or RV. There are lots of options in this market.

- No Bidding Wars. In 2005 we had one client that made an offer on ten homes. They lost the first nine to the 'feeding frenzy' that existed. Other buyers bid the properties up substantially from the original listing price. There were escalation clauses where buyers authorized their agents to outbid other offers by thousands of dollars. There is no competitive bidding in this buyer's market.

- You can make an offer. A few years ago when you made an offer, the only question was how high above the list price could the buyer reach in hopes of being the best offer on the table. Today the sell price list vs. price ration is about 90%. A seller will not be insulted if you 'make them an offer they can't refuse'.

- Patience is tolerated. In the hot seller's market that existed everything was rushed. Find a house before other buyers did. Hurry up and make the offer. Today a buyer can take their time. Look at several homes and think about your decision for a few hours.

- Due diligence is welcomed. In this market a buyer is encouraged to obtain a home inspection, termite inspection, and appraisal. In 2005 many buyers waived these contingencies in order gain an advantage with multiple offers.

- There are plenty of specs. In the not too distant past buyer had to 'play games' if they wanted a new home. There were lotteries and waiting lists in order to obtain new construction. Some buyers slept in their cars in order to get to the head of the lines. R.L. Brown estimates that builders have thousands of specs ready for immediate occupancy.

- Repair requests are welcomed. After a buyer completes a home inspection, they are allowed to submit a repair request to the seller. In the past a seller might insist the home was sold 'as is'. Many times, there were back-up buyers waiting for a primary buyer to upset the seller whose home was increasing in value almost daily.

- Few, if any investors. It is estimated that one third of all sales in 2005 were to investors. These non-owner occupied buyer caused the market to inflate and affordability to decline. Mortgage fraud became commonplace. It's a great time to buy without having to compete with hundreds of prospective landlords.

- Location, location, location. Today's buyers can find homes closer to work. In the past buyers flocked to Maricopa and Queen Creek in order to find affordable homes. In this market, reasonably priced homes are within biking or walking distance to schools, rapid transit lines, and relatives.

- Real Financing is available. The 'wink, wink' zero down, no doc, adjustable, sub-prime loans are gone. Fixed rates are back. FHA financing, first time homeowner bond programs, special loans for teachers, and police officers are back in business. It's a great time to buy real estate!

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, February 26, 2008

Real Estate Market Update

The study only does research on single family homes, NOT condos or townhouses. Below is a story from REUTERS news on today's report that was released. Keep in mind that when you are reading the report, there are still a tremendous amount of opportunities in South Florida's real estate market due to the exceptional prices and historically low interest rates.

Home prices accelerated to a record pace in the fourth quarter of 2007, with prices plunging 8.9 percent last year, according to a national home price index released on Tuesday. The quarterly drop in prices of existing single-family homes quickened to 5.4 percent in the final three months of last year from a 1.8 percent drop in the third quarter. Miami, remained the weakest market, reporting a double-digit annual decline of 17.5 percent, followed by Las Vegas and Phoenix at a 15.3 percent drop each. The three cities boasted of some of fastest rising home prices in 2006.

Charlotte, North Carolina, Portland, Oregon and Seattle were the only three metropolitan in the indexes where prices rose in 2007. Seattle, however, came in at only 0.5 percent, an almost flat growth rate.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Sunday, February 03, 2008

How does the Fed’s rate cut affect us?

Consumers are often confused when it comes to the subject of the Federal Reserve and how it affects mortgage interest rates. News coverage of the Fed can actually cause the confusion.

The Fed affects short-term interest rate maturities, the Federal Funds Rate, and the Overnight Lending Rate. These factors have a direct impact on the Prime Rate. However, it is a mistake to conclude that changes made by the Fed will cause a similar movement in the interest rates. Mortgage interest rates fluctuate with the market for mortgage backed securities, which trade on a daily basis, but are not widely published. Money to purchase mortgage-backed securities comes from overseas investors as well as domestic investors, and the flow of huge sums of monies to and from these securities is subject to competition from the stock market and complex economic and political influences.

A key (but not infallible) indicator for the movement of mortgage interest rates is the 10 year Treasury bond yield. It is widely quoted, and if it is heading up, you should be prepared to face higher mortgage rates. It fluctuates constantly, just like mortgage rates.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Thursday, January 31, 2008

New Tax Portability Calculator

The amendment is far from solving all the issues we have with the huge real estate tax problem in Florida. The main thing though is that it is a start and definitely can save many many people thousands of dollars each year. To see how the new amendment affects you, please click on the link below.

New Tax Portability Calculator

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, January 29, 2008

Home Price Drop Hits a New Record Low

January 29 2008: 10:19 AM EST

NEW YORK (CNNMoney.com)

The housing market is only getting worse, according to the latest report from S&P Case/Shiller released Tuesday.

Home prices were down 8.4 percent in November compared with last year in its 10-city index, a record low. The 20-city index also fell 7.7 percent.

The Case/Shiller report compares same-home sale prices. The industry considers it to be one of the most accurate snapshots of housing prices.

Previously, the largest year-over-year decline on record was 6.3 percent in April 1991. The November report marked the 11th consecutive month of negative returns for the index, and twenty-four months of decelerating returns.

Cities In Trouble

"We reached another grim milestone in the housing market in November," said Robert Shiller, Chief Economist at MacroMarkets LLC and co-creator the index in a statement.

"Not only did the 10-city composite index post another record low in its annual growth rate, but 13 of the 20 metro areas, each with data back to 1991, did the same."

The worst hit market of the 20 metro areas covered was Miami, where the median home fell a whopping 15.1 percent in value. San Diego prices also fell steeply, down 13.4 percent. Las Vegas was off 13.2 percent and Detroit by 13 percent.

Three cities did emerge with higher prices compared with 12 months ago: Prices rose 2.9 percent in Charlotte, N.C., 1.8 percent in Seattle and 1.3 percent in Portland, Ore. But even these markets have turned down over the last three months. Indeed, every city in the index recorded at least three consecutive months of falling prices through November.

The three biggest U.S. cities also recorded year-over-year declines; New York was down 4.8 percent, Los Angeles 11.9 percent and Chicago 3.9 percent. The losses in Los Angeles accelerated in November; that city recorded the largest month-over-month drop of any index city, 3.6 percent.

Tuesday's report came in the wake of many other surveys indicating that the housing market is getting worse. Foreclosure filings and the risks of future foreclosures were both up sharply; the number of new homes sold plunged more steeply than any year on record; and the pace of existing home sales fell to their lowest level in 27 years.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, January 22, 2008

Real Estate Tax Cut Amendment Video Explanation

https://www.cbflorida.com/public/Video/VoteYesOn1.wmv

I hope the two blogs answers all the questions you may have had on this somewhat confusing amendment.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, January 15, 2008

How to Prepare Your Home for Sale

Things you can do to ensure your home's exterior lands favorable first impressions:

- Stay on top of your lawn mowing and maintenance and tidy up your front landscaping.

- Plop a new, colorful welcome mat in front of the door.

- Embellish your door area with a nice, big potted plant to the side of the front door.

- Slap a fresh coat of paint on your door.

- Move all the toys, bicycles, and scooters away from the front of the house.

- Clean all your windows until they're sparkling.

- Invest in a new doorknob and lock - this will jazz up your door and provide greater security.

- Make sure your street numerals are polished and in place. Or, invest in a nice new set that stands out among your neighbors' standard numerals.

- Place a seasonal wreath or arrangement on your door.

- Repair any loose shingles - the last thing a potential buyer wants to worry about is the roof.

- Paint and repair your gutters.

Once the exterior wows your potential buyers, you'll need to continue to make an impact on them when they make their way inside. You can almost think of it as preparing for a formal dinner party. For starters, you can:

- Remove all the clutter - make sure kitchen and bathroom countertops are as clear as possible, try to keep toys organized in closets and shelves, temporarily remove any excess knickknacks or family photos if you tend to have a lot.

- Hang fresh clean towels in the bathrooms.

- Touch up your paint if your walls have a few rough spots. You probably already have the extra paint sitting in your garage.

- Vacuum your floor each morning. You may also want to think about getting your carpets clean before potential buyers view your house.

- Make sure all your faucets are drip-free.

- Replace any nonfunctioning bulbs in your light fixtures and vanities.

- Thoroughly clean all your appliances, including the inside of your oven and microwave.

- Place a beautiful centerpiece in the center of your dining room table.

- Eliminate odors as much as possible - place potpourri in the bathrooms, use air freshener and deodorizer, especially if you have indoor pets or there's a smoker in the house.

- Let the light in - open all your blinds and curtains. If your house's natural light leaves some rooms dark during certain portions of the day, turn on the lights if you know your house may be shown that day. If you have any decorative or track lighting, be sure it is on.

- If you have too much furniture, place some of it in storage.

- Add some final touches, a couple of fresh bouquets of flowers and some nice potted plants in decorative containers can do wonders.

Basically, just use common sense. Remember that everyone has his or her own style. You're not trying to impress with your particular brand of décor. Rather, you're trying to present a simple, clean, attractive home that exudes potential - an empty, yet enticing, palette for your home's next owners.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, January 08, 2008

Property Tax Cut Ammendment

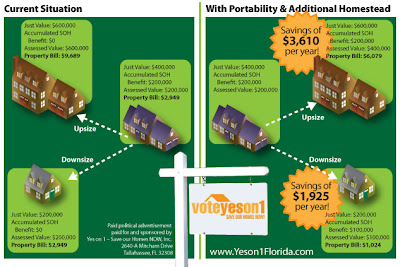

What are the Basic Facts on Amendment 1?

Passage of this amendment is critical to the future of Florida and it will put money back into the hands of most Florida property owners.

1) The property tax cut plan on the January 29 ballot would save taxpayers nearly $10 billion over five years.

2) Floridians have the power to cut property taxes by voting 'Yes on 1' on January 29, 2008.

3) Property taxes have doubled in the past six years, outpacing the average growth of homeowner’s salary.

4) Local governments have used their increase in revenues to greatly expand their budgets and reserves, instead of returning it to Florida’s families and small businesses.

What are the key benefits of Amendment 1?

Where Can I Get More Information on Amendment 1?

For more information about Amendment 1, visit: www.YesOn1Florida.com.

How Will Floridians Gain Property Tax Relief?

With the passage of Amendment 1, citizens will gain the freedom to purchase a new home without huge tax penalties, and rental home owners, second home owners and businesses will benefit by limited future tax increases. The amendment contains two provisions: doubling the homestead exemption and portability of the Save Our Homes tax benefit.

1) Double the homestead exemption for almost all homeowners, providing an average savings of about $240 annually. The new exemption applies fully to homesteads valued over $75,000 and partially for homesteads valued over $50,000. This new exemption does not apply to school taxes.

2) Allow portability: The Governor has heard from many constituents that they feel trapped in their homes. Portability will allow homeowners to transfer their Save Our Homes tax benefits from their old home to a newly purchased home. Portability applies to homes purchased in 2007 and later, and the benefit is capped at $500,000.

How Does Portability Help People Who Want to Move?

Amendment 1 benefits those who want to move into a different home, seniors seeking to downsize, and business owners facing rising property values.

Looking for a larger house?

If you bought a house for $95,000 in 1995 and its current market value now is $300,000 and the assessed value is only $150,000-- you could transfer the full $150,000 difference to buy a more expensive home.

If the purchase of your new home costs $400,000, you would be paying about $6,300 in taxes without portability. But with the tax savings from Amendment 1 including the Save our Homes portability and the double homestead exemption, the new annual taxes would be about half or $3,600.

Want to downsize?

Under the new tax plan, portability also will apply if you want to move to a less expensive property. Instead of transferring the difference, your transfer will be your existing Save our Home percentage.

For example, if you live in a $300,000 house with an assessed value of $150,000, you pay taxes on $125,000 or about $2,100. If you wanted to move to a $200,000 condo the savings will be significant.

In this case, you would bring 50% or $100,000 in savings that reduces your assessed value to $100,000 on the new property. With the newly increased $50,000 homestead exemption from Amendment 1, the taxable value for all local government taxes other than school taxes would fall to $50,000. The new total annual tax bill would be about $1,000 or about half of the old tax bill.

Do you live in a mobile home?

More than 1.1 million Floridians currently live in mobile home or manufactured housing parks and communities. Currently, if you live on a leased lot in a park or community, you are paying tangible personal property taxes on your porches, sunrooms, storage rooms, and carports. With the passage of Amendment 1, you will have an exemption up to $25,000…so most of you will no longer pay this tax at all!

Comparison chart

How would Amendment 1 help rein in local government spending?

Amendment 1 isn't just about cutting taxes. It is about controlling government spending. It is a reality check for local governments that feasted on escalating property values over much of the past decade instead of lowering tax rates. As property values rose, tax collections soared. Levies doubled between 1997 and last year, including 42 percent in just three years. Property taxes grew three times faster than growth in population and inflation combined. Even after lawmakers approved a rollback of the tax rate last year, almost half of Florida's cities and counties set their rates higher. Others raised fees for services, like fire protection, that should be paid for through property taxes.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Thursday, January 03, 2008

Mortgage Forgiveness Debt Relief Act of 2007

- It is a retroactive and temporary change to the tax code, mortgage debt forgiven by a lender between January 1, 2007 and December 31, 2009 will not be deemed taxable income to the homeowner. (must still report it to the IRS)

- It does not apply to investors; it only applies to taxpayers' principal rsidences that they have occupied for two or more years.

- The mortgage debt forgiven will only be the "acquisition indebtedness", the sum total borrowed for the acquisition of the property. Refinances of this debt would also qualify, but only up to the total amount borrowed to purchase, and in some cases to substantially improve, the property.

- A maximum of two million dollars of mortgage debt may be forgiven.

Since every case is different, please check with your attorney and CPA to see if you qualify.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com

Tuesday, January 01, 2008

Happy New Year!!!

The paradox of our time in history is that we have taller buildings but shorter tempers, wider Freeways , but narrower viewpoints. We spend more, but have less, we buy more, but enjoy less. We have bigger houses and smaller families, more conveniences, but less time. We have more degrees but less sense, more knowledge, but less judgment, more experts, yet more problems, more medicine, but less wellness.

We drink too much, smoke too much, spend too recklessly, laugh too little, drive too fast, get too angry, stay up too late, get up too tired, read too little, watch TV too much, and pray too seldom.

We have multiplied our possessions, but reduced our values. We talk too much, love too seldom, and hate too often.

We've learned how to make a living, but not a life. We've added years to life not life to years. We've been all the way to the moon and back, but have trouble crossing the street to meet a new neighbor. We conquered outer space but not inner space. We've done larger things, but not better things.

We've cleaned up the air, but polluted the soul. We've conquered the atom, but not our prejudice. We write more, but learn less. We plan more, but accomplish less. We've learned to rush, but not to wait. We build more computers to hold more information, to produce more copies than ever, but we communicate less and less.

These are the times of fast foods and slow digestion, big men and small character, steep profits and shallow relationships. These are the days of two incomes but more divorce, fancier houses, but broken homes. These are days of quick trips, disposable diapers, throwaway morality, one night stands, overweight bodies, and pills that do everything from cheer, to quiet, to kill. It is a time when there is much in the showroom window and nothing in the stockroom. A time when technology can bring this letter to you, and a time when you can choose either to share this insight, or to just hit delete...

Remember; spend some time with your loved ones, because they are not going to be around forever.

Remember, say a kind word to someone who looks up to you in awe, because that little person soon will grow up and leave your side.

Remember, to give a warm hug to the one next to you, because that is the only treasure you can give with your heart and it doesn't cost a cent.

Remember, to say, 'I love you' to your partner and your loved ones, but most of all mean it. A kiss and an embrace will mend hurt when it comes from deep inside of you.

Remember to hold hands and cherish the moment for someday that person will not be there again.

Give time to love, give time to speak! And give time to share the precious thoughts in your mind.

Amit Bhuta

Real Estate Helper

Kendall Village Homes

(305) 439-3031

www.DadeCountyMLS.com